While there was talk of a "crypto winter" in 2022, it seems that spring has sprung in the digital assets space in 2023. Bitcoin, by far the largest and best-recognized cryptocurrency, has surged more than 80% year to date to regain some of its lost luster. The popular alternative cryptocurrency ether, colloquially known as ethereum, is also up almost 60% since the start of the year. (All year-to-date gains in this piece are current through July 18.)

Interestingly enough, though, some crypto-related stocks are up even more – with some mining-related companies having doubled, tripled or even quintupled already in 2023. In fact, in the wake of a big court decision on July 13 that found Ripple (XRP) was not a security, some stocks immediately tacked on double-digit percentage gains.

There's admittedly a much different risk profile for cryptocurrency stocks vs. cryptocurrency itself. It's in many ways similar to the differences between owning physical gold that is tied to commodity market pricing trends and a gold miner that extracts that physical gold from the ground and is measured by its revenue, profitability and other fundamentals.

If you prefer the more tangible nature of stocks as an alternative to owning cryptocurrency like bitcoin directly, consider one of these seven names:

Block Inc. (SQ)

Though the core business of Block is its leading digital and mobile payment platform Square, co-founder and CEO Jack Dorsey rebranded the company as Block in part because of his strong support for the long-term potential of blockchain technology and digital assets. This includes the company's development of Cash App, a platform where users can buy, sell, send and receive bitcoin. On top of all this, the latest quarterly filings show SQ has invested a cumulative $220 million directly in bitcoin. Shares have actually underperformed this year relative to other companies on this list, thanks to continued operations in the red along with regulatory scrutiny of Cash App. That said, aggressive investors could see this as a buying opportunity based on long-term potential.

Year-to-date returns: 25.8%

Coinbase Global Inc. (COIN)

Coinbase provides financial infrastructure and technology for the "crypto economy" in the United States, including operating one of the largest cryptocurrency exchanges in the world. Particularly after the 2022 collapse of rival exchange FTX, Coinbase remains one of the only "lit" markets – a market showing the bid and ask prices of participants – providing a regulated venue in the digital assets space for domestic participants. Though the regulatory environment is always uncertain, the willingness of Coinbase to engage with the regulatory community including the Securities and Exchange Commission gives it a measure of legitimacy in an industry that is admittedly still a bit rough around the edges.

Year-to-date returns: 195.5%

Hive Digital Technologies Ltd. (HIVE)

The smallest stock on this list at only about $500 million in market value, Hive operates as a cryptocurrency mining company in Canada, Sweden and Iceland. It recently rebranded from Hive Blockchain to Hive Digital Technologies to emphasize that it does more than just digital assets (it also offers cloud computing services). Hive also uses its tech know-how to operate data centers and offers other infrastructure solutions. It's not the first reinvention of this company either, as it was formerly known as Leeta Gold Corp., mining physical metals prior to its 2017 shift in strategy. Whatever the history though, you can't argue with the tremendous performance of this stock year to date as it benefits from its current business model.

Year-to-date returns: 288.9%

Marathon Digital Holdings Inc. (MARA)

Marathon is currently one of the largest bitcoin mining companies in the U.S. It also provides general services to the crypto industry including transaction and custody verification as well blockchain security work. The company currently operates 150,000 or so miners at locations ranging from Texas to North Dakota to Abu Dhabi, and in July reported production of 5,120 BTC year to date in 2023. It also bills itself as one of the most sustainable miners in the world, making big investments in renewable energy such as wind power. If you are interested in investing in publicly traded bitcoin miners but don't particularly like the size of their carbon footprints, the $3 billion MARA is worth a look.

Year-to-date returns: 391.5%

MicroStrategy Inc. (MSTR)

Though MicroStrategy's core operations include providing business intelligence, mobile software and cloud-based enterprise technology services, it has become popular these days thanks to a heavy reliance on digital assets to boost its corporate balance sheet. Back in 2020, then-CEO Michael Saylor announced his intention to stop holding cash and instead rely on crypto to fund its corporate treasury – beginning with buying $250 million worth of bitcoin. Considering bitcoin is up threefold since then, history seems to have proven out that move. And going forward, investors who want to play stocks as a proxy for direct bitcoin investment can take a stake in MSTR and its current hoard of roughly 140,000 bitcoin as of the end of its fiscal first quarter.

Year-to-date returns: 214.9%

Nvidia Corp. (NVDA)

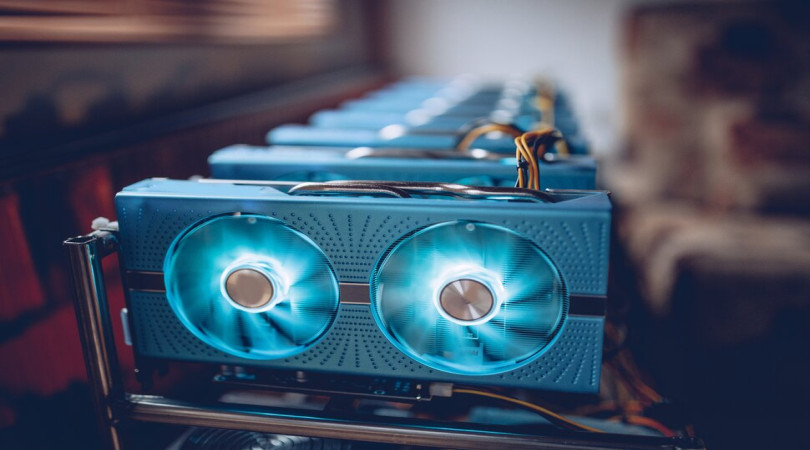

Though it is a bit of an indirect play on the crypto frenzy, high-octane momentum stock Nvidia nevertheless earns a place on this list because of its amazing performance in 2023 and its nearly indispensable role as the semiconductor manufacturer of choice for the industry. Nvidia's legacy business of graphics processing units evolved from high-end video gaming graphics cards to "superchips" for data-intensive tasks like running artificial intelligence and machine learning software, performing cryptocurrency mining and other cutting-edge applications. If you're looking to play crypto stocks tangentially without owning a direct stake in bitcoin or ethereum, NVDA is a top performer worth a look.

Year-to-date returns: 225.1%

Riot Platforms Inc. (RIOT)

Riot Platforms is a Colorado-based cryptocurrency mining company that independently mines bitcoin along with providing co-location services for institutional-scale bitcoin mining companies and other critical infrastructure for related operations. Though it previously operated as a medical device maker known as Bioptix, the company changed its name and its fundamental business model back in 2017 to ride the crypto wave. It's now valued at more than $3 billion and is one of the preeminent publicly traded mining companies.

Year-to-date returns: 439.2%